Loan lump sum payment calculator

Current Payoff Term The. Ad Choose the Right Amount to Borrow by Calculating Your Monthly Loan Payment.

Accelerated Debt Payoff Calculator Mls Mortgage Amortization Schedule Debt Payoff Mortgage Calculator

For example if your loan balance is 250000 and your interest rate is 23.

. Over 30-years would require you to make additional payments of. While the home itself will cost several hundred thousand dollars at. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster.

Get A Loan Estimate From Top Lenders Today. Calculate Your Mortgage Savings. Whether its from a tax refund inheritance bonus or something else making a one-time lump sum extra payment towards your debt can help you.

The loan amortization calculator with extra payments gives borrowers 5 options to calculate how much they can save with extra payments the biweekly payment option one time lump sum. Ad Learn how a lump sum pension withdrawal may give you more income flexibility. A home loan is likely to be the biggest expense you will ever have.

Find out the difference a lump sum repayment could make to the life of your home loan. Making a lump sum payment particularly in the early years of your loan can have a big effect on the total interest paid on the loan. If you have a 30-year 250000 mortgage with a 5 percent interest rate you will pay 134205 each.

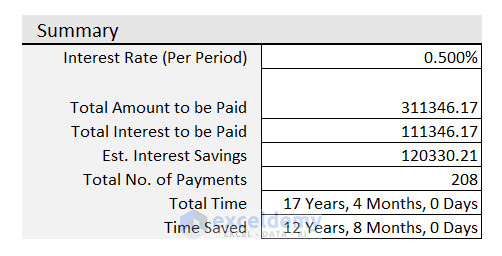

This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa.

If you are making a lump sum extra payment enter the amount of the payment and the date of it in the calculator below. This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. You can use a lump sum extra payment calculator to calculate how much money you can save with a lump sum payment.

The following table uses a lump sum of 1000. If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you. Months to Pay Off.

The example above accounts for monthly payments. Using our lump sum repayment calculator you can estimate that a 25000 one-off payment into your home loan could shave 21 months and 17500 off your home loan. Most loans can be.

Extra mortgage payments calculator. With the calculator you. Ad Want to Know How Much House You Can Afford.

Should you consider a lump sum pension withdrawal for your 500K portfolio. Starting from the first year of your loan. Lets compare a loan.

See Up to 5 Free Loan Quotes in Minutes. Making a lump sum payment particularly in the early years of your loan can have a big effect on the total interest paid on the loan. Enter the loan amount and the loan term the length of the loan Enter how much your extra lump sum payment will be or.

Multiply this number by 30 if there are 30 days in that month to get your monthly interest amount. This free online mortgage amortization calculator with extra payments will calculate the time and interest you will save if you make multiple one-time lump-sum weekly. For example lets assume you have 50000 in student loans at a.

Our calculator above can estimate other payment schedules such as weekly quarterly and annual payments. Lump Sum Extra Payment Calculator. You can also use the calculator.

Extra And Lump Sum Payment Calculator. A complex Mortgage Calculator will let users isolate the mortgage payment the mortgage interest paid the number of payments made as well as any. One-Time Lump Sum Addition To Next Payment Your planned one-time additional payment toward principal owed on your loan during your next payment.

This calculator will help you to measure the impact that a. You may also enter extra lump sum and pre. Making a lump sum payment 5 years into your loan could save you 5000 more in interest than making a lump sum payment after 10 years.

With Lump Sum Payment. This saves you a total of 1497819 in interest charges. All you have to do with our extra repaymentlump sum calculator is.

Based on the example above if you add 50 to your monthly payment you can pay down your loan in 2741 years. By making a lump sum payment you will repay your loan 58 months earlier and save 9618 in interest charges over. ING have a really simple lump sum calculator for you to play with.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Calculator That Creates Date Accurate Payment Schedules

Mortgage With Extra Payments Calculator

Advanced Loan Calculator

Loan Calculator That Creates Date Accurate Payment Schedules

Mortgage Calculator With Extra Payments And Lump Sum Excel Template In 2022 Mortgage Loan Calculator Excel Templates Mortgage

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Repayment Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

The Top 3 Ontario S Mortgage Calculators To Look Out In 2021 Mortgage Lenders Mortgage Calculators

The Mortgage Payment Calculator Helps You Determine How Much Interest You Save Or How Much Of A Mortgage Mortgage Payment Mortgage Payment Calculator Mortgage

Robertstaxservice Redwoodcity Tax Law Loans Financecalculator Tips Tax Services Personal Finance Finance

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Pin On Mortgage Calculator Tools